Starting in 2023, the success of short dramas has become undeniable. According to ChinaDaily, the market size for China's online micro-dramas reached 37.39 billion yuan in 2023, marking a year-on-year growth of 267.65%. By 2027, this market is projected to expand to 100 billion yuan.

However, is the success of short dramas solely due to their fast-paced plots and the pervasive element of "fun"?

Imagine a cross between a TV soap opera and a TikTok reel. That’s the essence of short drama apps, originally created in China and now rapidly gaining traction in international markets. Each episode is just one to two minutes long, with a typical series featuring around 100 episodes.

Designed for phone screens and shorter attention spans, these low-budget, simplified stories revolve around betrayal, revenge, family drama, and star-crossed lovers—essentially any plot twist that amps up the drama and keeps viewers hooked with cliffhanger after cliffhanger. Character development takes a backseat to the intense, quick-hitting drama that makes these shows perfect for binge-watching, even if you’ve only got a minute to spare.

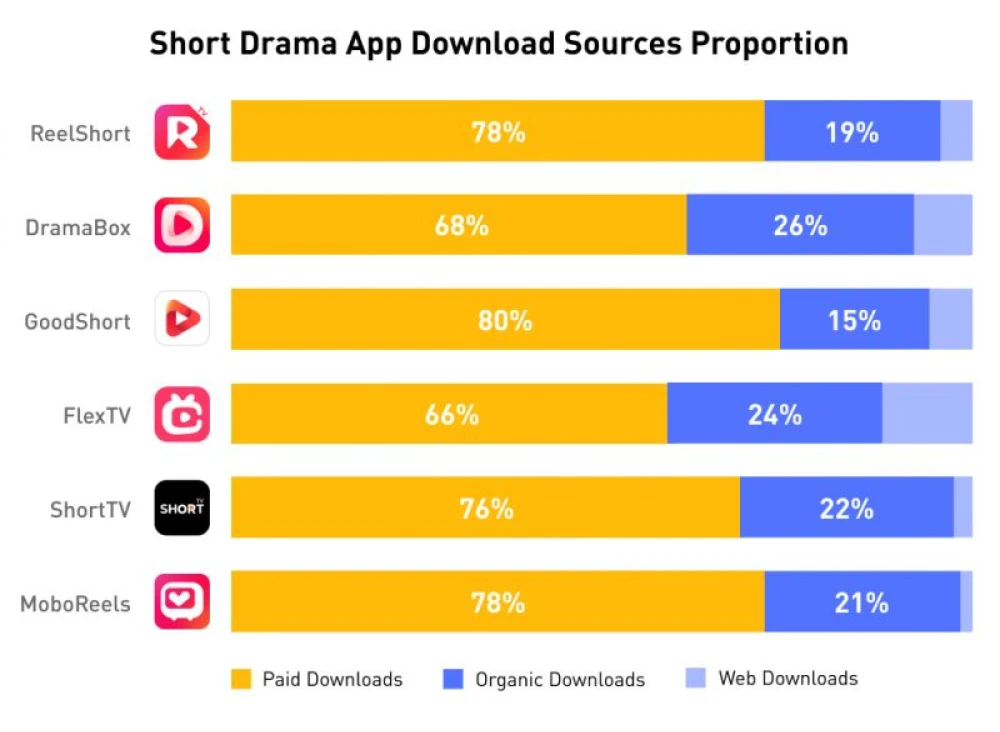

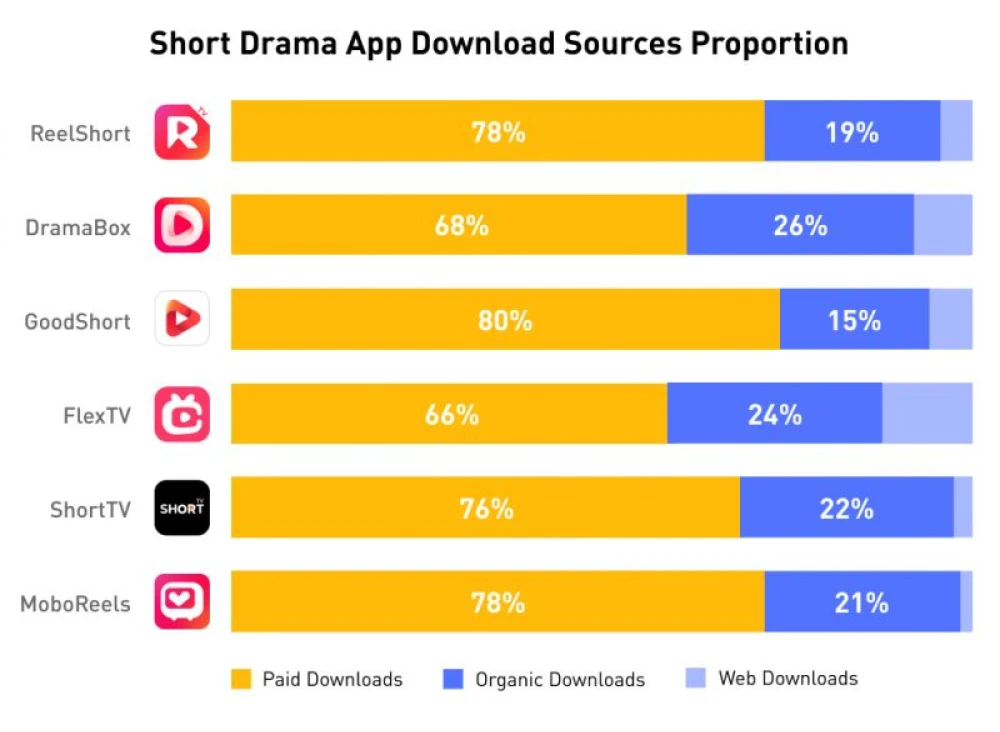

Unlike traditional TV dramas or online series, short dramas typically lack significant production budgets and platform support. Without post-production promotion, these dramas face a high risk of obscurity. Their success largely hinges on investments in streaming traffic, relying on exposure across various platforms to generate returns.

In traditional marketing, TV commercials share similar characteristics with short dramas. Due to market constraints, limited broadcast platforms, and restricted dissemination channels, TVCs struggle to generate positive brand feedback without substantial traffic support, let alone profitability. Expanding this analogy to basic marketing strategies, whether through viral posts, short video promotions, or ranking recommendations, it’s increasingly challenging to stand out online amidst complex, homogeneous content.

More than 40 Chinese short drama apps have entered global markets, collectively amassing nearly 55 million downloads and generating $170 million in in-app purchases. The U.S. is currently the biggest consumer of overseas short drama apps, providing 60—70% of these apps’ total revenue outside of China.

Advertising is key to the short drama apps success, making it a smart investment that brings in a highly profitable user base. While the cost of producing a show is relatively low—around $150,000 for a remake in the U.S. and even less for a dubbed original—millions are invested in promoting these shows to potential viewers. But with big advertising budgets come big rewards. And Mobupps has it’s own case study regarding the short drama app success.

Case Study: Mobupps and short drama apps

Background: Our client, a Chinese short-form video streaming app, specializes in delivering serialized dramas optimized for mobile viewing. These shows focus on rapid plot twists, heightened emotional conflicts, and minimal character development. The production approach is streamlined, with low-budget sets, simple costumes, and a cast of primarily unknown actors. The app is available on iOS, and we have been driving 1.2k installs per day.

Client’s Goal: The client aimed to achieve a Day 0 ROAS of 85%. However, our publishers consistently outperformed this target, reaching an impressive 144% D0 ROAS.

Campaign Strategy:

1. Traffic Sources: Initially, our strategy revolved around optimizing mobile traffic channels to attract a highly engaged audience. Given the short-form nature of the content, we targeted users likely to appreciate quick, drama-packed episodes, resulting in steady daily installs.

2. Introduction of CTV Traffic: As the campaign progressed, we introduced Connected TV traffic into the mix. This strategic shift aimed to diversify our user acquisition channels and tap into a broader audience segment that consumes content on larger screens. The integration of CTV allowed us to reach users who prefer watching serialized dramas on their TVs but still interact with mobile devices for apps and in-app purchases.

3. Optimization and Scaling: After introducing CTV traffic, we closely monitored the performance, focusing on key metrics like install volume, user engagement, and most critically, ROAS. Mobile and CTV traffic enabled us to not only meet but exceed the client’s initial ROAS target. The continuous optimization of creatives and targeting strategies allowed us to maintain high engagement levels while scaling up the campaign effectively.

Results:

Through a combination of targeted mobile traffic and strategic CTV integration, we successfully drove high-quality installs and maximized the client’s ROAS. This case study highlights the effectiveness of blending different traffic sources to optimize performance and achieve outstanding results in a competitive market.

Ready to increase acquisition rates and achieve outstanding results to your short drama app? Contact us today.

Starting in 2023, the success of short dramas has become undeniable. According to ChinaDaily, the market size for China's online micro-dramas reached 37.39 billion yuan in 2023, marking a year-on-year growth of 267.65%. By 2027, this market is projected to expand to 100 billion yuan.

However, is the success of short dramas solely due to their fast-paced plots and the pervasive element of "fun"?

Imagine a cross between a TV soap opera and a TikTok reel. That’s the essence of short drama apps, originally created in China and now rapidly gaining traction in international markets. Each episode is just one to two minutes long, with a typical series featuring around 100 episodes.

Designed for phone screens and shorter attention spans, these low-budget, simplified stories revolve around betrayal, revenge, family drama, and star-crossed lovers—essentially any plot twist that amps up the drama and keeps viewers hooked with cliffhanger after cliffhanger. Character development takes a backseat to the intense, quick-hitting drama that makes these shows perfect for binge-watching, even if you’ve only got a minute to spare.

Unlike traditional TV dramas or online series, short dramas typically lack significant production budgets and platform support. Without post-production promotion, these dramas face a high risk of obscurity. Their success largely hinges on investments in streaming traffic, relying on exposure across various platforms to generate returns.

In traditional marketing, TV commercials share similar characteristics with short dramas. Due to market constraints, limited broadcast platforms, and restricted dissemination channels, TVCs struggle to generate positive brand feedback without substantial traffic support, let alone profitability. Expanding this analogy to basic marketing strategies, whether through viral posts, short video promotions, or ranking recommendations, it’s increasingly challenging to stand out online amidst complex, homogeneous content.

More than 40 Chinese short drama apps have entered global markets, collectively amassing nearly 55 million downloads and generating $170 million in in-app purchases. The U.S. is currently the biggest consumer of overseas short drama apps, providing 60—70% of these apps’ total revenue outside of China.

Advertising is key to the short drama apps success, making it a smart investment that brings in a highly profitable user base. While the cost of producing a show is relatively low—around $150,000 for a remake in the U.S. and even less for a dubbed original—millions are invested in promoting these shows to potential viewers. But with big advertising budgets come big rewards. And Mobupps has it’s own case study regarding the short drama app success.

Case Study: Mobupps and short drama apps

Background: Our client, a Chinese short-form video streaming app, specializes in delivering serialized dramas optimized for mobile viewing. These shows focus on rapid plot twists, heightened emotional conflicts, and minimal character development. The production approach is streamlined, with low-budget sets, simple costumes, and a cast of primarily unknown actors. The app is available on iOS, and we have been driving 1.2k installs per day.

Client’s Goal: The client aimed to achieve a Day 0 ROAS of 85%. However, our publishers consistently outperformed this target, reaching an impressive 144% D0 ROAS.

Campaign Strategy:

1. Traffic Sources: Initially, our strategy revolved around optimizing mobile traffic channels to attract a highly engaged audience. Given the short-form nature of the content, we targeted users likely to appreciate quick, drama-packed episodes, resulting in steady daily installs.

2. Introduction of CTV Traffic: As the campaign progressed, we introduced Connected TV traffic into the mix. This strategic shift aimed to diversify our user acquisition channels and tap into a broader audience segment that consumes content on larger screens. The integration of CTV allowed us to reach users who prefer watching serialized dramas on their TVs but still interact with mobile devices for apps and in-app purchases.

3. Optimization and Scaling: After introducing CTV traffic, we closely monitored the performance, focusing on key metrics like install volume, user engagement, and most critically, ROAS. Mobile and CTV traffic enabled us to not only meet but exceed the client’s initial ROAS target. The continuous optimization of creatives and targeting strategies allowed us to maintain high engagement levels while scaling up the campaign effectively.

Results:

Through a combination of targeted mobile traffic and strategic CTV integration, we successfully drove high-quality installs and maximized the client’s ROAS. This case study highlights the effectiveness of blending different traffic sources to optimize performance and achieve outstanding results in a competitive market.

Ready to increase acquisition rates and achieve outstanding results to your short drama app? Contact us today.