Mobupps is a company where we fight fraud every day. When we win a battle, there are always new reinforcements. This is why we have such extraordinary officers on our team, just like our COO Bella Karsir, who does this job on a daily basis for years, and 24metrics – our biggest ally and tools supplier. This is why today Bella is going to share her personal battles history and observations with you.

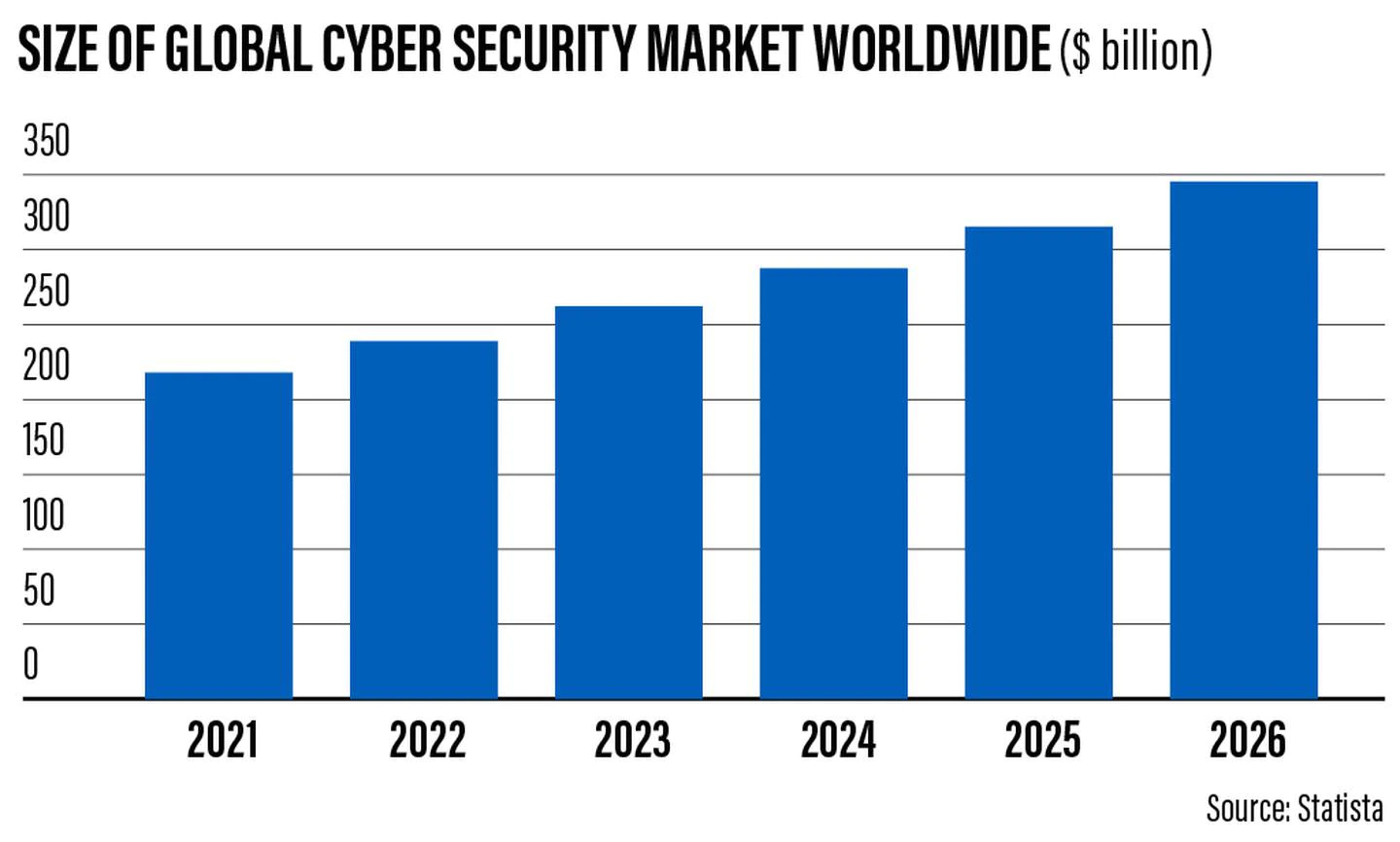

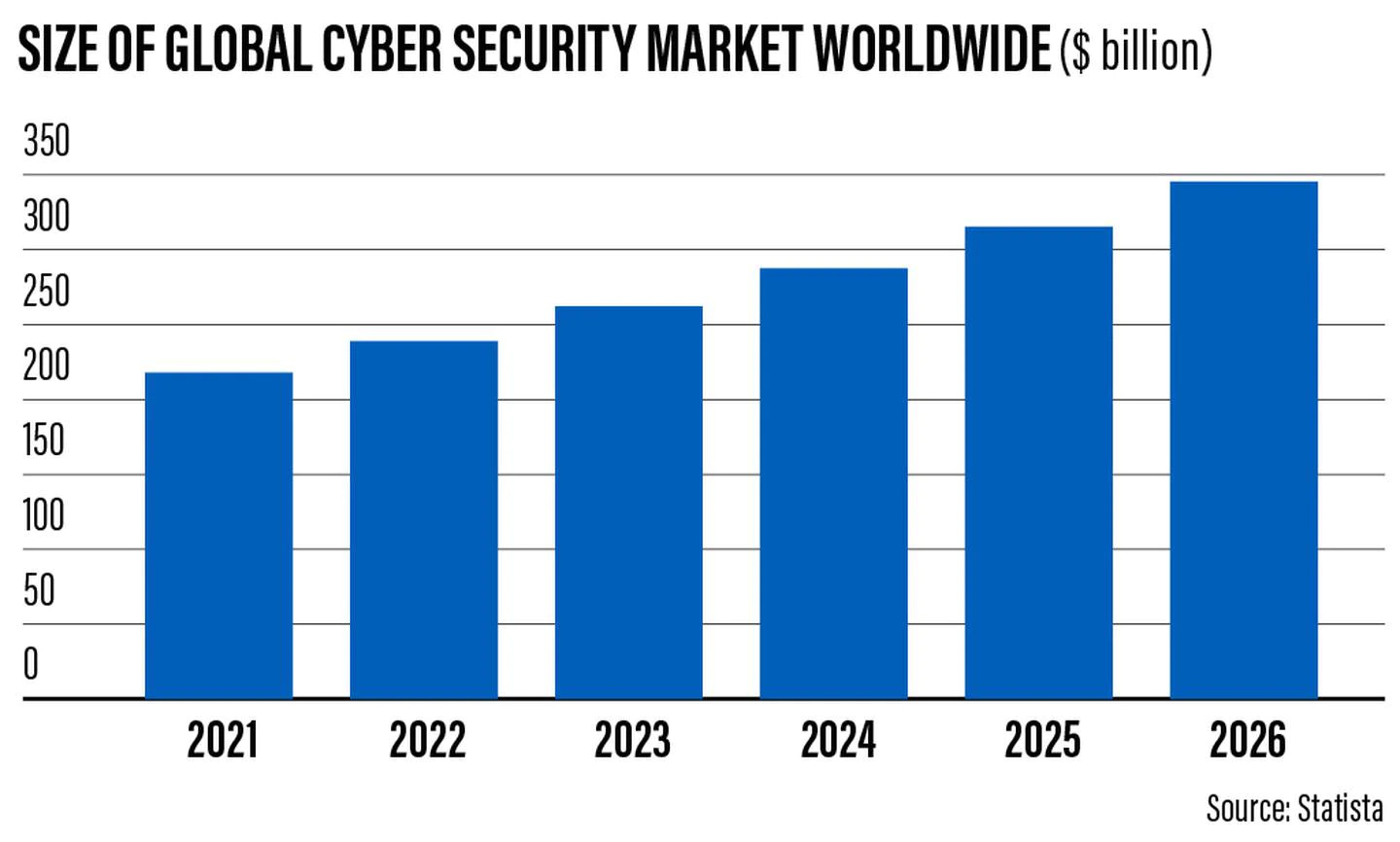

During the pandemic, application usage time and total screen time have increased significantly, while the number of fraud attacks has increased even more. By 2025, cybercrime will cost companies around the world an estimated more than $ 300 billion a year. According to the Accenture Cost of Cybercrime Study, 43% of cyberattacks target small businesses, but only 14% are prepared to defend themselves.

Mobupps would like to share knowledge of the hottest mobile ad fraud trends for 2022 and our solution to this major problem.

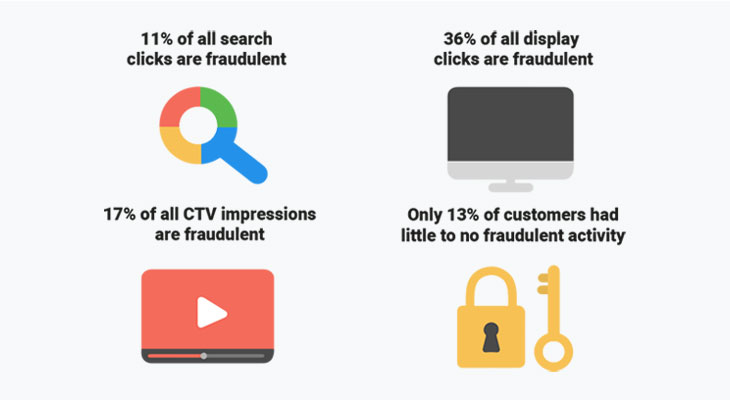

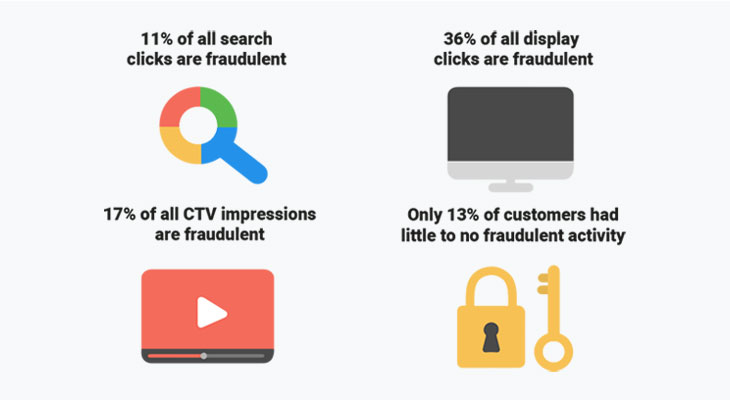

Click fraud is the illegal act of clicking on a pay-per-click (PPC) ad to increase a site’s revenue or spend a company’s advertising budget. Click fraud differs from invalid clicks (duplicate or made by the ad host/publisher) in that it is intentional, malicious, and cannot result in the ad being sold.

In other words, Click fraud = any non-genuine click on the advertisers’ paid ads, for example:

The widespread use of digital payments, including cryptocurrency platforms, has increased the cyber threats for fintech companies in 2022, we will see a big increase in the number of scammers trying to improvise with phishing and social engineering to attack cryptocurrency platforms.

Using malware for cryptography and infecting the system for mining cryptocurrency will become a more serious threat this year, and we all need to be warned.

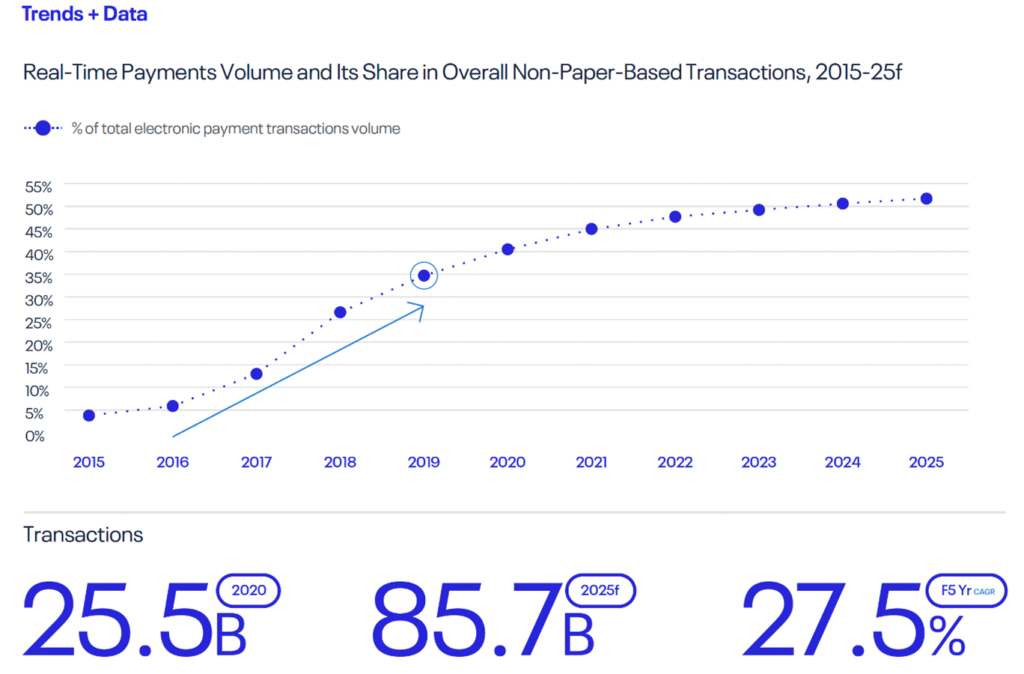

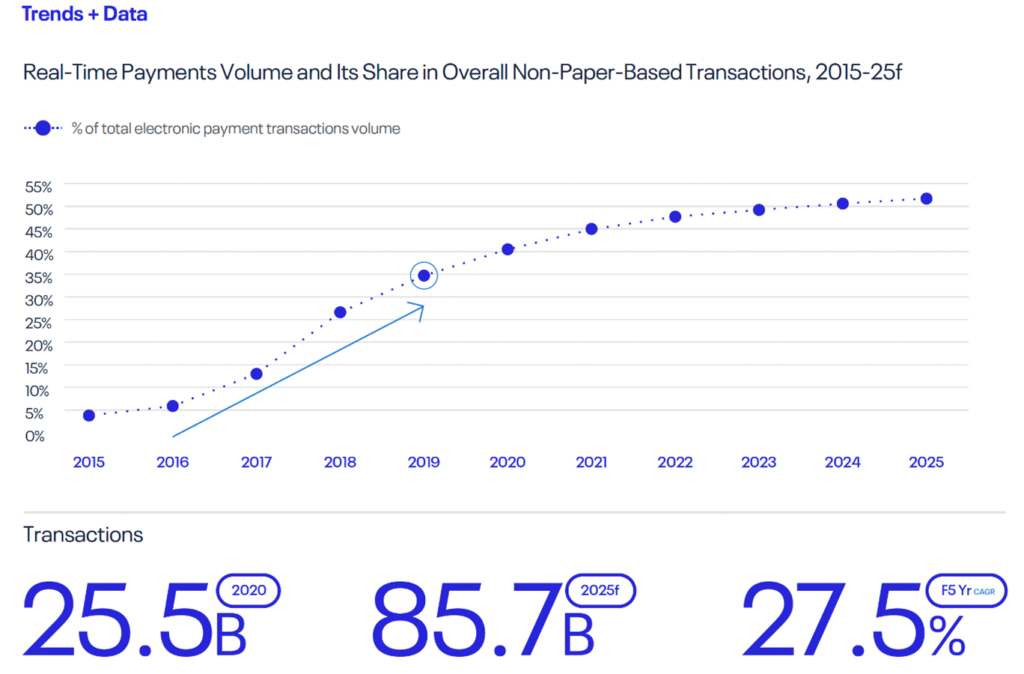

Faster money = faster fraud. Real-time payments increased by 61% between 2021 and 2022 and are set to rise again by 23% between 2022 and 2025.

From mobile payments, all the way to Buy Now Pay Later – have provided the easiest way for fraudsters to quickly monetize and cash out – converting money to other forms of currency like crypto and then laundering the funds through multiple fraudulently-established accounts.

The speed of real-time payments presents unique challenges to businesses because they often can’t be revoked or easily traced, so detection can be more difficult.

Mobupps works with 2 main systems to track and control fraud, Mobupps fraud prevention tools:

In our innovative digital world – Fraudsters are taking advantage of the rise in mobile traffic and attacking across multiple touchpoints. App developers and big agencies like Mobupps must remain informed and vigilant if we’re to evade fraudsters and their endless attempts to steal the ad spend.

Please make sure that ad clicking is from genuine resources, and work with click fraud prevention tools that fight anti-click fraud. But if you need someone to hold a torch in this field, our Mobupps team is always ready to help. These buttons should work, but I’m not sure, try testing them out.

Mobupps is a company where we fight fraud every day. When we win a battle, there are always new reinforcements. This is why we have such extraordinary officers on our team, just like our COO Bella Karsir, who does this job on a daily basis for years, and 24metrics – our biggest ally and tools supplier. This is why today Bella is going to share her personal battles history and observations with you.

During the pandemic, application usage time and total screen time have increased significantly, while the number of fraud attacks has increased even more. By 2025, cybercrime will cost companies around the world an estimated more than $ 300 billion a year. According to the Accenture Cost of Cybercrime Study, 43% of cyberattacks target small businesses, but only 14% are prepared to defend themselves.

Mobupps would like to share knowledge of the hottest mobile ad fraud trends for 2022 and our solution to this major problem.

Click fraud is the illegal act of clicking on a pay-per-click (PPC) ad to increase a site’s revenue or spend a company’s advertising budget. Click fraud differs from invalid clicks (duplicate or made by the ad host/publisher) in that it is intentional, malicious, and cannot result in the ad being sold.

In other words, Click fraud = any non-genuine click on the advertisers’ paid ads, for example:

The widespread use of digital payments, including cryptocurrency platforms, has increased the cyber threats for fintech companies in 2022, we will see a big increase in the number of scammers trying to improvise with phishing and social engineering to attack cryptocurrency platforms.

Using malware for cryptography and infecting the system for mining cryptocurrency will become a more serious threat this year, and we all need to be warned.

Faster money = faster fraud. Real-time payments increased by 61% between 2021 and 2022 and are set to rise again by 23% between 2022 and 2025.

From mobile payments, all the way to Buy Now Pay Later – have provided the easiest way for fraudsters to quickly monetize and cash out – converting money to other forms of currency like crypto and then laundering the funds through multiple fraudulently-established accounts.

The speed of real-time payments presents unique challenges to businesses because they often can’t be revoked or easily traced, so detection can be more difficult.

Mobupps works with 2 main systems to track and control fraud, Mobupps fraud prevention tools:

In our innovative digital world – Fraudsters are taking advantage of the rise in mobile traffic and attacking across multiple touchpoints. App developers and big agencies like Mobupps must remain informed and vigilant if we’re to evade fraudsters and their endless attempts to steal the ad spend.

Please make sure that ad clicking is from genuine resources, and work with click fraud prevention tools that fight anti-click fraud. But if you need someone to hold a torch in this field, our Mobupps team is always ready to help. These buttons should work, but I’m not sure, try testing them out.