China’s iGaming sector presents one of the most intriguing paradoxes in the global digital economy. On one hand, China is the largest gaming market in the world, generating US$45 billion in 2023, powered by a mobile-first population and global giants like Tencent and NetEase. On the other hand, gambling remains strictly illegal on the mainland, permitted only in Macau and Hong Kong, which operate under separate regulatory systems.

This creates a dual-market reality in China: a booming gaming vertical (mobile, eSports, social) and an iGaming/gambling sector that largely grows outside of China, driven by offshore platforms targeting Chinese users. For marketers and advertisers, this duality offers both massive scale and intense complexity.

In this article, Mobupps takes a closer look at these dynamics, unpacking the opportunities, challenges, and marketing strategies that can help companies navigate one of the most complex yet rewarding gaming markets in the world.

China’s gaming user base is enormous, with 674 million gamers in 2024, nearly half the population. Mobile gaming drives 73% of total revenues, followed by the rapid rise of eSports, which exceeded USD 6 billion in 2023.

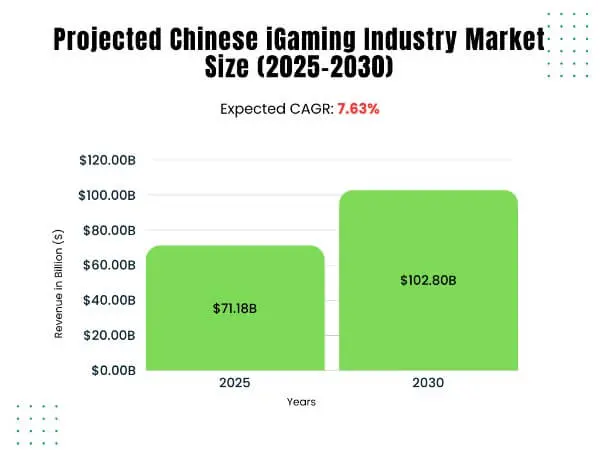

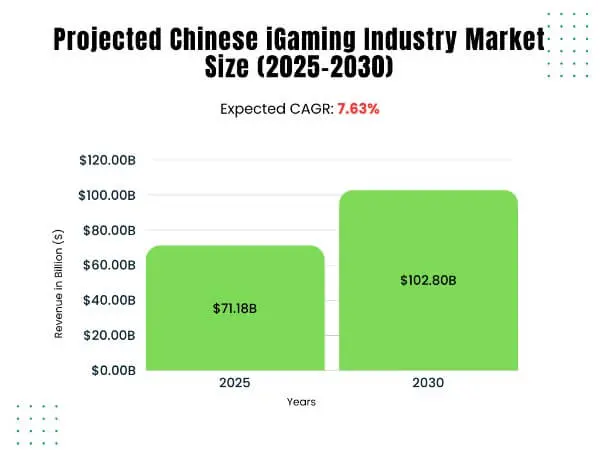

The combined gaming market across mobile, PC, and eSports is projected to grow from USD 71.18 billion in 2025 to USD 102.80 billion by 2030, reflecting a 7.63% CAGR.

Offshore iGaming platforms, especially in sports betting, continue to attract Chinese users despite legal barriers, with the market projected to grow at a 20.4% CAGR through 2030.

Demographically, the average gamer is 35 years old, and 46% of gamers are women. Tier-2 cities like Chengdu and Wuhan are now growth engines, with lite versions of games designed for lower-cost smartphones expanding reach.

Source: Link

This split means that iGaming operators cannot legally operate in mainland China. Instead, many offshore companies localize their offerings to target Chinese players, though they face constant enforcement risks.

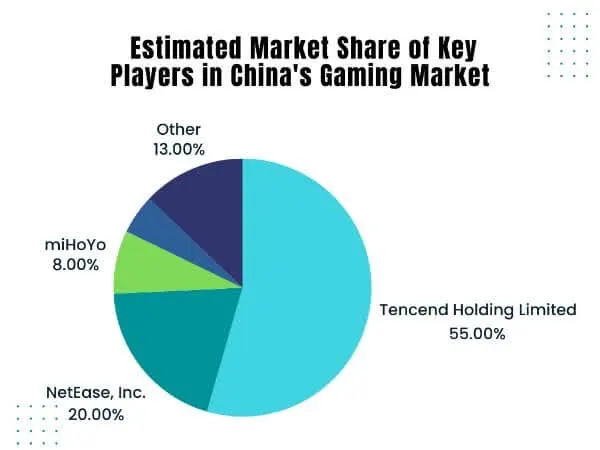

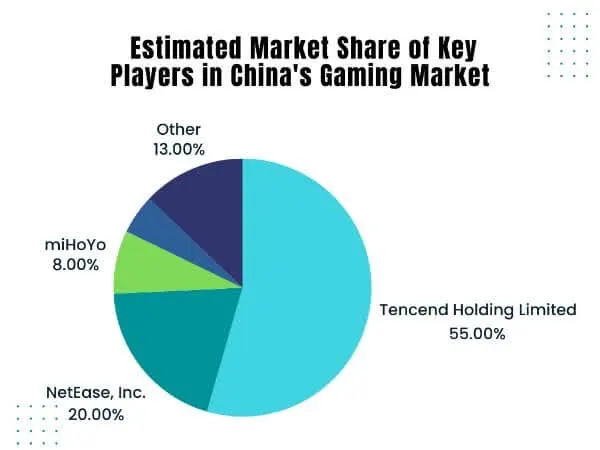

When it comes to China’s gaming market, two names dominate the conversation: Tencent Holdings and NetEase. Together, they control more than 70% of the domestic market, setting the pace for the entire industry.

Tencent sits comfortably at the top with a market share of around 50%, powered by mobile blockbusters such as Honor of Kings and PUBG Mobile, which generate billions of dollars in revenue every year. Beyond its homegrown successes, Tencent has also expanded its global influence through acquisitions, including Riot Games (developer of League of Legends) and a stake in FromSoftware (creator of Elden Ring).

NetEase holds roughly 20% of the market, maintaining its edge through both self-developed hits and smart partnerships with international studios like Blizzard Entertainment. Titles such as Justice Online Mobile and Dunk City Dynasty have helped it post steady annual growth of over 11%.

Rising challengers like miHoYo (valued at US$4.2 billion) are making waves with community-driven RPGs such as Genshin Impact and Honkai: Star Rail. Meanwhile, 37 Interactive Entertainment is carving out its niche in strategy and role-playing games, and Perfect World Games continues to focus on AAA development and overseas expansion.

While Tencent and NetEase remain the heavyweights, a new generation of studios is steadily reshaping the market, adding diversity and global ambition to China’s already powerful gaming vertical.

Source: Link

Asia’s iGaming market is on the rise, valued at nearly USD 11.9 billion in 2024, creating fertile ground for new players to step in. China, in particular, has seen explosive growth thanks to the country’s mobile-first culture. Smartphones are the primary gaming device for millions of consumers. Adding to this momentum, the National Press and Publication Administration (NPPA) has recently approved a wave of new titles, signaling a possible easing of regulations. This more favorable stance could open doors for innovation, fresh IPs, and international collaborations.

Despite the potential, navigating China’s gaming ecosystem isn’t without hurdles. Policy shifts, such as proposed restrictions on in-game spending and loot box rewards, have already spooked investors, sparking volatility in the sector. Regulations remain tight and evolving, reflecting Beijing’s commitment to curbing excessive playtime and promoting healthier gaming habits. On top of that, while gaming is widely embraced, gambling carries a cultural stigma in China. Outside of Macau and Hong Kong, where it is legal, gambling remains heavily restricted, limiting acceptance and creating reputational challenges for companies in the iGaming space.

At the same time, new technologies are rewriting the rules of engagement. Blockchain is emerging as a tool for greater transparency, fairness, and cross-currency integration in online gambling ecosystems. VR and AR are taking player immersion to new heights, while AI adds layers of personalization and security. And with 5G rolling out nationwide, developers can now deliver real-time multiplayer experiences with near-zero latency, sharper graphics, and seamless connectivity. Together, these innovations are improving the user experience and shaping the next generation of digital entertainment in China.

China might be the world’s biggest gaming market, but the real breakout stories for Chinese developers are happening elsewhere. With tough regulations and limited advertising space at home, many studios are turning their attention to the U.S. and other Asian markets where it is easier to achieve scale, monetization, and creative freedom.

We’ve seen it firsthand. One Chinese-origin casual game studio managed to reach a 200% D7 ROAS in the U.S. by focusing on quality traffic and tighter budget control. Another achieved a 26% ROAS lift, 31% downloads growth, 8x CR increase, and a Top 5 ranking in the U.S. charts, thanks to smart audience segmentation and multi-channel campaigns.

The biggest growth for Chinese game developers is happening not inside China, but abroad. Those who are willing to adapt quickly, invest in the right technology, and meet players where they are will succeed before their competitors.

What Strategic Moves Make the Difference?

China’s iGaming market is both vast and tightly regulated. While most gambling remains prohibited outside Macau and Hong Kong, mobile gaming and eSports drive revenues. Oversight by the NPPA adds uncertainty, yet dominance by Tencent and NetEase coexists with the rise of niche studios. At the core, consumers favor mobile-first, socially interactive gameplay, turning gaming into a cultural mainstay.

For legal gaming companies, the strategic playbook is clear:

For offshore iGaming operators, the challenge is different: they grow outside China, often in Southeast Asia or Europe, while attempting to capture Chinese audiences. Here, marketing relies heavily on localization, cultural nuance, and discreet acquisition tactics, since aggressive promotion risks government crackdowns.

China’s iGaming sector is set to expand further, powered by the strength of mobile and the rapid rise of eSports. Yet regulatory risk will continue to loom, demanding agility and adaptability from industry players.

How can companies strike the right balance between growth ambitions and regulatory compliance, turning restrictions into an opportunity for sustainable leadership? That’s where Mobupps comes in.

With more than 16 years of experience in global user acquisition and monetization, Mobupps enables gaming and iGaming companies to scale in highly regulated markets. Mobupps helps brands with market-specific targeting, creative optimization, and compliance-driven strategies. Contact marketing@mobupps.com to thrive in one of the most complex gaming environments in the world.

China’s iGaming sector presents one of the most intriguing paradoxes in the global digital economy. On one hand, China is the largest gaming market in the world, generating US$45 billion in 2023, powered by a mobile-first population and global giants like Tencent and NetEase. On the other hand, gambling remains strictly illegal on the mainland, permitted only in Macau and Hong Kong, which operate under separate regulatory systems.

This creates a dual-market reality in China: a booming gaming vertical (mobile, eSports, social) and an iGaming/gambling sector that largely grows outside of China, driven by offshore platforms targeting Chinese users. For marketers and advertisers, this duality offers both massive scale and intense complexity.

In this article, Mobupps takes a closer look at these dynamics, unpacking the opportunities, challenges, and marketing strategies that can help companies navigate one of the most complex yet rewarding gaming markets in the world.

China’s gaming user base is enormous, with 674 million gamers in 2024, nearly half the population. Mobile gaming drives 73% of total revenues, followed by the rapid rise of eSports, which exceeded USD 6 billion in 2023.

The combined gaming market across mobile, PC, and eSports is projected to grow from USD 71.18 billion in 2025 to USD 102.80 billion by 2030, reflecting a 7.63% CAGR.

Offshore iGaming platforms, especially in sports betting, continue to attract Chinese users despite legal barriers, with the market projected to grow at a 20.4% CAGR through 2030.

Demographically, the average gamer is 35 years old, and 46% of gamers are women. Tier-2 cities like Chengdu and Wuhan are now growth engines, with lite versions of games designed for lower-cost smartphones expanding reach.

Source: Link

This split means that iGaming operators cannot legally operate in mainland China. Instead, many offshore companies localize their offerings to target Chinese players, though they face constant enforcement risks.

When it comes to China’s gaming market, two names dominate the conversation: Tencent Holdings and NetEase. Together, they control more than 70% of the domestic market, setting the pace for the entire industry.

Tencent sits comfortably at the top with a market share of around 50%, powered by mobile blockbusters such as Honor of Kings and PUBG Mobile, which generate billions of dollars in revenue every year. Beyond its homegrown successes, Tencent has also expanded its global influence through acquisitions, including Riot Games (developer of League of Legends) and a stake in FromSoftware (creator of Elden Ring).

NetEase holds roughly 20% of the market, maintaining its edge through both self-developed hits and smart partnerships with international studios like Blizzard Entertainment. Titles such as Justice Online Mobile and Dunk City Dynasty have helped it post steady annual growth of over 11%.

Rising challengers like miHoYo (valued at US$4.2 billion) are making waves with community-driven RPGs such as Genshin Impact and Honkai: Star Rail. Meanwhile, 37 Interactive Entertainment is carving out its niche in strategy and role-playing games, and Perfect World Games continues to focus on AAA development and overseas expansion.

While Tencent and NetEase remain the heavyweights, a new generation of studios is steadily reshaping the market, adding diversity and global ambition to China’s already powerful gaming vertical.

Source: Link

Asia’s iGaming market is on the rise, valued at nearly USD 11.9 billion in 2024, creating fertile ground for new players to step in. China, in particular, has seen explosive growth thanks to the country’s mobile-first culture. Smartphones are the primary gaming device for millions of consumers. Adding to this momentum, the National Press and Publication Administration (NPPA) has recently approved a wave of new titles, signaling a possible easing of regulations. This more favorable stance could open doors for innovation, fresh IPs, and international collaborations.

Despite the potential, navigating China’s gaming ecosystem isn’t without hurdles. Policy shifts, such as proposed restrictions on in-game spending and loot box rewards, have already spooked investors, sparking volatility in the sector. Regulations remain tight and evolving, reflecting Beijing’s commitment to curbing excessive playtime and promoting healthier gaming habits. On top of that, while gaming is widely embraced, gambling carries a cultural stigma in China. Outside of Macau and Hong Kong, where it is legal, gambling remains heavily restricted, limiting acceptance and creating reputational challenges for companies in the iGaming space.

At the same time, new technologies are rewriting the rules of engagement. Blockchain is emerging as a tool for greater transparency, fairness, and cross-currency integration in online gambling ecosystems. VR and AR are taking player immersion to new heights, while AI adds layers of personalization and security. And with 5G rolling out nationwide, developers can now deliver real-time multiplayer experiences with near-zero latency, sharper graphics, and seamless connectivity. Together, these innovations are improving the user experience and shaping the next generation of digital entertainment in China.

China might be the world’s biggest gaming market, but the real breakout stories for Chinese developers are happening elsewhere. With tough regulations and limited advertising space at home, many studios are turning their attention to the U.S. and other Asian markets where it is easier to achieve scale, monetization, and creative freedom.

We’ve seen it firsthand. One Chinese-origin casual game studio managed to reach a 200% D7 ROAS in the U.S. by focusing on quality traffic and tighter budget control. Another achieved a 26% ROAS lift, 31% downloads growth, 8x CR increase, and a Top 5 ranking in the U.S. charts, thanks to smart audience segmentation and multi-channel campaigns.

The biggest growth for Chinese game developers is happening not inside China, but abroad. Those who are willing to adapt quickly, invest in the right technology, and meet players where they are will succeed before their competitors.

What Strategic Moves Make the Difference?

China’s iGaming market is both vast and tightly regulated. While most gambling remains prohibited outside Macau and Hong Kong, mobile gaming and eSports drive revenues. Oversight by the NPPA adds uncertainty, yet dominance by Tencent and NetEase coexists with the rise of niche studios. At the core, consumers favor mobile-first, socially interactive gameplay, turning gaming into a cultural mainstay.

For legal gaming companies, the strategic playbook is clear:

For offshore iGaming operators, the challenge is different: they grow outside China, often in Southeast Asia or Europe, while attempting to capture Chinese audiences. Here, marketing relies heavily on localization, cultural nuance, and discreet acquisition tactics, since aggressive promotion risks government crackdowns.

China’s iGaming sector is set to expand further, powered by the strength of mobile and the rapid rise of eSports. Yet regulatory risk will continue to loom, demanding agility and adaptability from industry players.

How can companies strike the right balance between growth ambitions and regulatory compliance, turning restrictions into an opportunity for sustainable leadership? That’s where Mobupps comes in.

With more than 16 years of experience in global user acquisition and monetization, Mobupps enables gaming and iGaming companies to scale in highly regulated markets. Mobupps helps brands with market-specific targeting, creative optimization, and compliance-driven strategies. Contact marketing@mobupps.com to thrive in one of the most complex gaming environments in the world.